It’s ironic that something that started out with the Diner’s Club should be at the center of the cashless restaurant controversy. Most historians agree that the modern incarnation of the credit card began in 1950 with the birth of the Diner’s Club card. But card-based payments have grown beyond just credit cards to include debit cards and even gift cards. So why is there a backlash against restaurants that only want to accept card-based payment types? Let’s explore the controversy.

The Benefits of a Cashless Restaurant Business

You don’t have to dig too deeply to find a whole host of reasons that a restaurant might not want to accept cash. Cash is a pain for restaurants in many ways.

Cash Must Be Deposited

Unlike credit card transactions, cash collected in your restaurant must be deposited in your bank account. That means a trip to the bank, ATM or dropbox. Every day. Sometimes more than once a day.

Cash Must Be Kept On Hand

If you accept cash, you are going to have to make change. So you need to keep a variety of bill denominations and change on the premises at all times. What would you do if you couldn’t make change for a customer?

Easier Accounting

Most point-of-sale systems have the ability to keep track of card-based purchases and either import that data directly into accounting systems or at least product reports that can be easily entered into such systems. No need to count cash and coins. And it lessens the risk of mistakes. Counting back change may be difficult for some employees and mistakes happen leading to discrepancies.

Cash Makes Your Business a Target

When bank robber Willie Sutton was asked why he robbed banks, he astutely replied, “that’s where the money is.” This is true for any business handling large amounts of cash. You are at risk for being robbed.

Employee Theft

Bad guys in masks aren’t the only threat to your cash-based business. In fact, employee theft is most likely a bigger issue for most businesses. And for those that deal in cash, the temptation and opportunity for employee theft is even greater.

Cash is Dirty

The phrase “dirty money” is more true than you might want to believe. Cash is one of the germiest things that a restaurant employee is likely to touch with their bare hands. Germs that cause things like pneumonia are commonly found on bills. And employees routinely handle cash without gloves.

But Credit Cards Have Issues Too

With all the black marks against using cash, you might think that credit cards are a great solution. But credit cards come with potential issues themselves.

Transaction Fees

There are a number of factors that go into the fees that a restaurant might pay for using a card-based payment. What type of card is being used? Are they requiring a PIN? Do they require a signature? No matter what, there will be a fee of some sort. These fees typically run between 2-4% of the transaction. And when you are dealing with a business that has razor thin margins, those extra fees can add up fast.

Data Security

Credit card data can be stolen. Data breaches have become commonplace in almost every industry. And the restaurant industry is no exception. Many smaller chains and independent operators do not have technical staff that can assist them in securing their data. So they are at the mercy of third-party vendors who may or may not be able to secure their customers’ data.

Privacy

Even if your data isn’t stolen, it isn’t necessarily private either. The terms and conditions of your card may allow the card issuer to do all sorts of things with your data, including selling it or sharing it with other companies for marketing and sales purposes. So if you want to keep a transaction private, cash may be your only option.

The Cashless Restaurant Controversy

So now that we’ve laid out all the players and their respective issues in the cash versus credit conundrum it’s time to find out what the fuss is all about.

The issue reached a boiling point in Philadelphia where the city council banned cashless stores. This included retail and restaurants. The rationale most often stated is that there is a feeling that cashless restaurants discriminate against lower socioeconomic status (SES) individuals. That is, those that fall on the lower end of the SES spectrum may not have credit or debit cards. Thus, they would be unable to make purchases in a cashless business.

Another group that is affected by the cash ban is teens. Teenagers typically do not have credit cards. But we know that teens do spend money. So if you prohibit cash payments, you may be excluding this potentially lucrative demographic segment.

The new law requires businesses to accept cash as a form of payment. But there is no federal law that requires businesses to accept cash, even though it is legal tender.

Very quickly after the move by Philadelphia, the state of New Jersey followed suit and banned cashless restaurants and retail establishments.

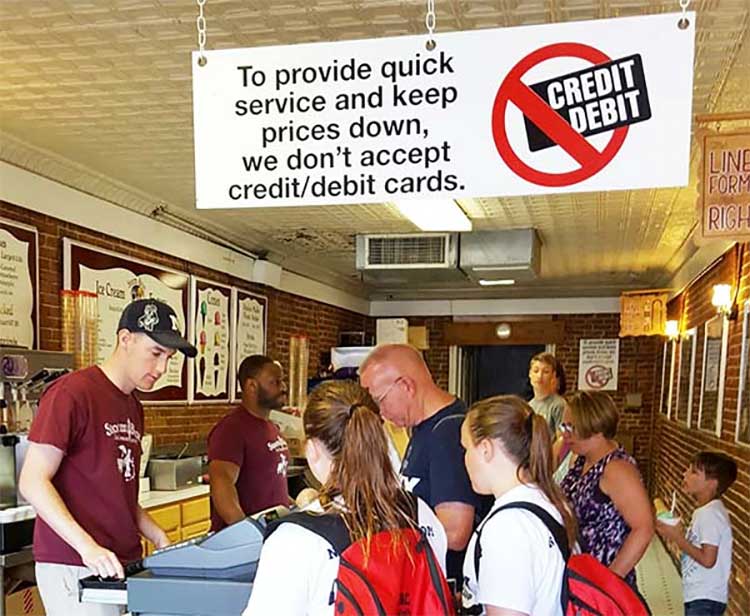

But Cash Only Restaurants Are OK?

The other side of this messy coin is that cash only restaurants exist as well. Most will say that they deal in cash to avoid the transaction fees incurred from using credit cards. But critics point out that cash only restaurants can also lead to tax evasion since there is no paper trail. No transaction record means that there is no sales tax record. And the state could be losing sales tax revenue.

But beyond the potential fraud issues, cash only restaurants annoy a lot of people. Want to eat here? There’s an ATM around the corner.

Some cash only restaurants have ATM’s right inside the business. And while it may feel convenient, it may be owned by the business and any transaction fees you pay for withdrawals could benefit that same business. It’s sort of like a sneaky transaction fee.

Speaking of Transaction Fees

As we mentioned, credit card transaction fees can really eat into restaurant profits. So what is a restaurateur to do? What if you charged an extra fee to cover those transaction fees? Turns out, that’s exactly what some establishments have started to do.

SUNDAY SHOWDOWN: Do you think restaurants should pass along credit card transaction fees as an extra charge on bills?

Yay or Nay? https://t.co/tdMfLDK12M

— NewsTalk 96.5 KPEL (@kpel965) April 1, 2019

But is it legal?

Yes, it is. Thanks to a 2013 class action suit, restaurants are allowed to charge up to 4% as a surcharge to cover credit card fees. First and foremost, be sure to check your state and local laws pertaining to the collection of surcharges. These will supercede everything. And collecting surcharges is currently prohibited in 10 states—California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma, and Texas. It’s 11 if you count Puerto Rico because the practice is prohibited there as well. But beyond that, there are also certain rules.

For example, surcharges can only be charged on true credit card transactions. You may not collect a surcharge on debit or pre-paid debit (such as Visa giftcards) cards. This holds true even if the customer chooses the “credit” option to process the card.

The fee for the surcharge must be clearly listed on the customer’s receipt. And it needs to be explicit as to what the fee is for.

You cannot call this a “convenience fee.” That term has a specific meaning and it does not apply to credit card surcharges.

Lastly, you cannot collect a surcharge unless you offer an alternate method of payment that does not require the surcharge.

In other words, cashless restaurants can’t collect a surcharge since they don’t allow the customer to pay cash.

Wrapping It All Up

Card payment continues to grow around the world. But it might be a bit early to declare the death of cash. Every restaurateur we spoke to said that they prefer cash because it is more profitable for them. But in the same breath, they acknowledge that they need to offer card-based payments for convenience.

So the battle between cash and credit cards will continue. Paying with credit cards has been shown to increase what customers spend and even lead to larger tips for serving staff. But cash payments are definitely more profitable for the business, even if it does present some challenges.

As new payment methods creep into modern use, we may find ourselves having this debate again over cellphone payments in just a few years. It’s an issue that will be with us for quite a while.

I don’t care if they charge 4 percent more, so tip will be 4 percent less.

So you are going to take money out of a servers pocket to account for the business owners decisions,. Bet your food gets spit in a lot